Accelerate Solar with Domestic Content

IronRidge offers racking systems that use 100% domestically-produced components. Our products—made in the United States—include rails, structural fasteners, roof attachments, and the BX Ballasted System.

To meet the qualifying criteria for tax credit incentives, solar projects must use a combination of modules, inverters (MLPE or string), and racking with a minimum aggregate threshold of 40% Domestic Content.*

NO NEED TO SETTLE: Pick reputable products that your crews like installing. IronRidge offerings are listed to UL 2703 and UL 3741, tested rigorously, and manufactured to the highest quality standards.

DO YOUR HOMEWORK: Understand terms and definitions. Obtain letters from the manufacturer to share with your tax and legal counsel. Make sure they can also provide traceability in case of audit.

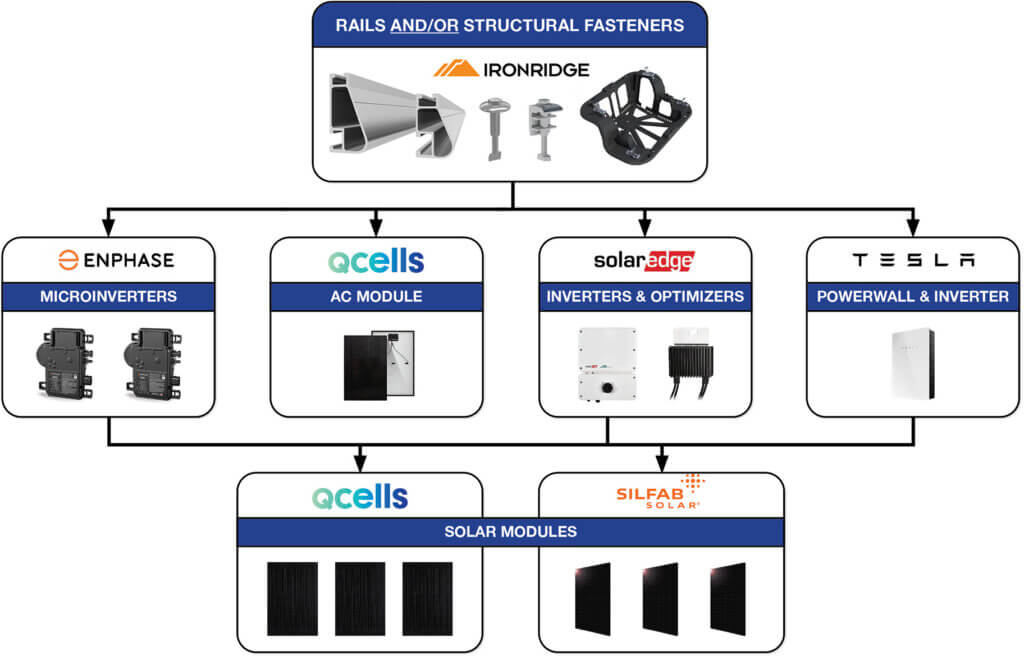

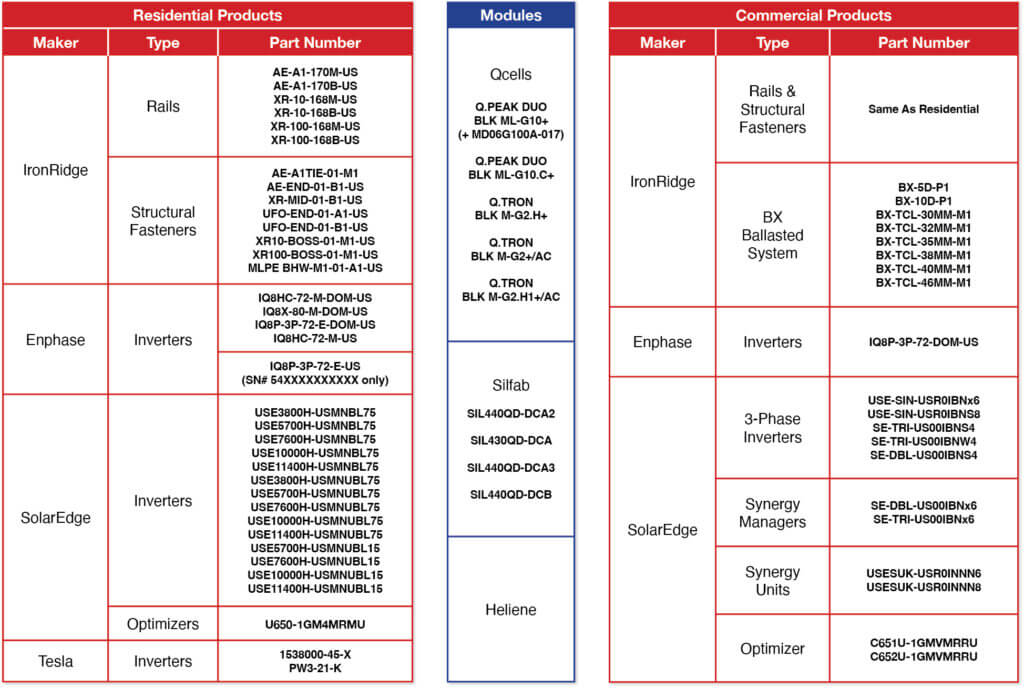

STACK MANUFACTURERS: Our partnerships with the leading module and inverter manufacturers allow multiple avenues for you to reach 40%. See below for the current list of qualified vendors.

READ THE FINE PRINT: Only taxpayers offering third-party-owned systems and other commercial entities are eligible. Installation companies and homeowners do not directly qualify. Consult a tax professional.

BE FULLY PREPARED: Audits by financiers, commercial project owners, other taxpayers, and the IRS are serious business. Ensure manufacturing partners can help you navigate potential oversight.

STAY IN THE KNOW: This complex and nuanced topic is now on its third Notice from the Treasury Department. Updated guidance may come at any time. We promise to keep you properly informed.

Pathways to 40-45% Domestic Content

Domestic SKUs

Documentation

Domestic Brochure | Traceability Guide | NOTE: This page is updated to reflect Notice 2025-08. The page for Notice 2024-41 can be found here.

DISCLAIMER: IronRidge does not provides tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to be relied upon in place of professional advice. You should consult your own advisors before engaging in any transaction.

*Treasury guidance currently specifies 40% per the Adjusted Percentage Rule (APR). To qualify for the domestic content tax credit adder for the Investment Tax Credit (ITC) or Production Tax Credit (PTC), the PV system must satisfy the APR. While the PTC specifies a 5% yearly increase in the APR (currently at 45% for 2025), the ITC’s language was not update to reflect a similar escalation. Some view this as an oversight that may indicate a need for caution. Entities may view the needed percentage to qualify as 45%. Speak to your tax and legal counsel for guidance on the threshold for your project(s).