The U.S. Treasury issued a press release to announce this update. Included in this release is Notice 2025-08, Domestic Content Bonus Credit Amounts under the Inflation Reduction Act of 2022: First Updated Elective Safe Harbor modifying Notice 2024-41.

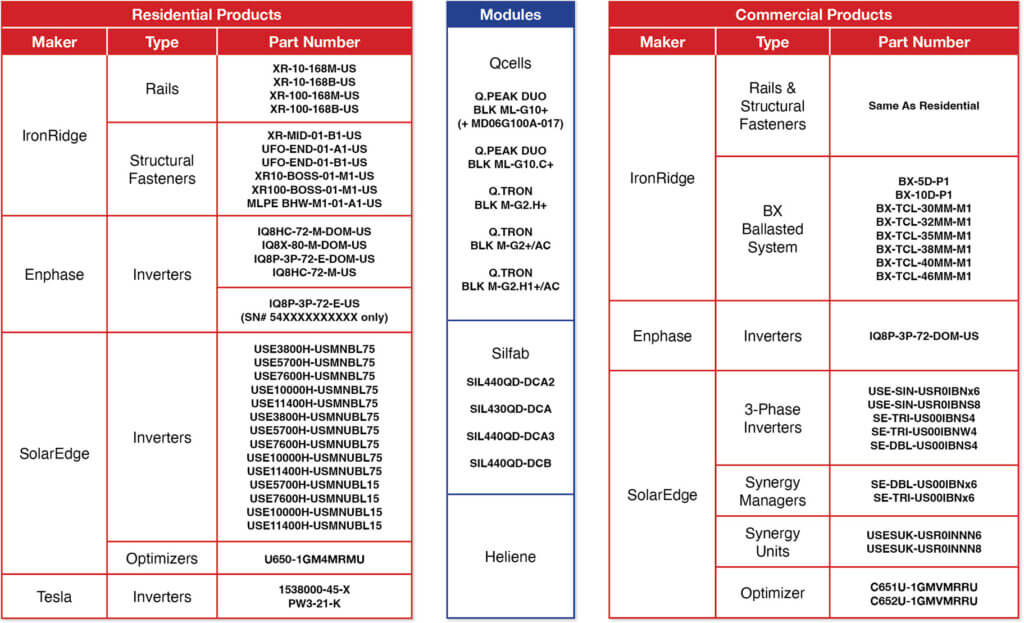

The Safe Harbor Table includes substantive changes to the previous Safe Harbor table. These changes significantly impact manufacturers of modules, inverters and racking systems and changes the calculus developers will use to build their systems. This notice takes effect as of the date it was published, January 16th, 2025, and will remain usable guidance that date forward.

Should future updated guidance or rulings from Treasury be published, this guidance will be valid for 90 days from the issuance of that updated guidance. Similarly, the Safe Harbor Table provided in May of 2024 (Notice 2024-01) is still available for use for projects that have already commenced construction or will commence construction on or before April 16th, 2025.

A third option remains viable, as well. The “Direct Cost Method” as outlined in Notice 2023-38 is available for use and will remain so until further notice is provided by the Treasury.

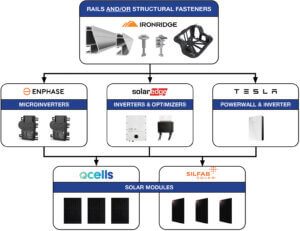

- Projects must use a combination of modules, MLPE and racking with a minimum aggregate Domestic Content of 40%.*

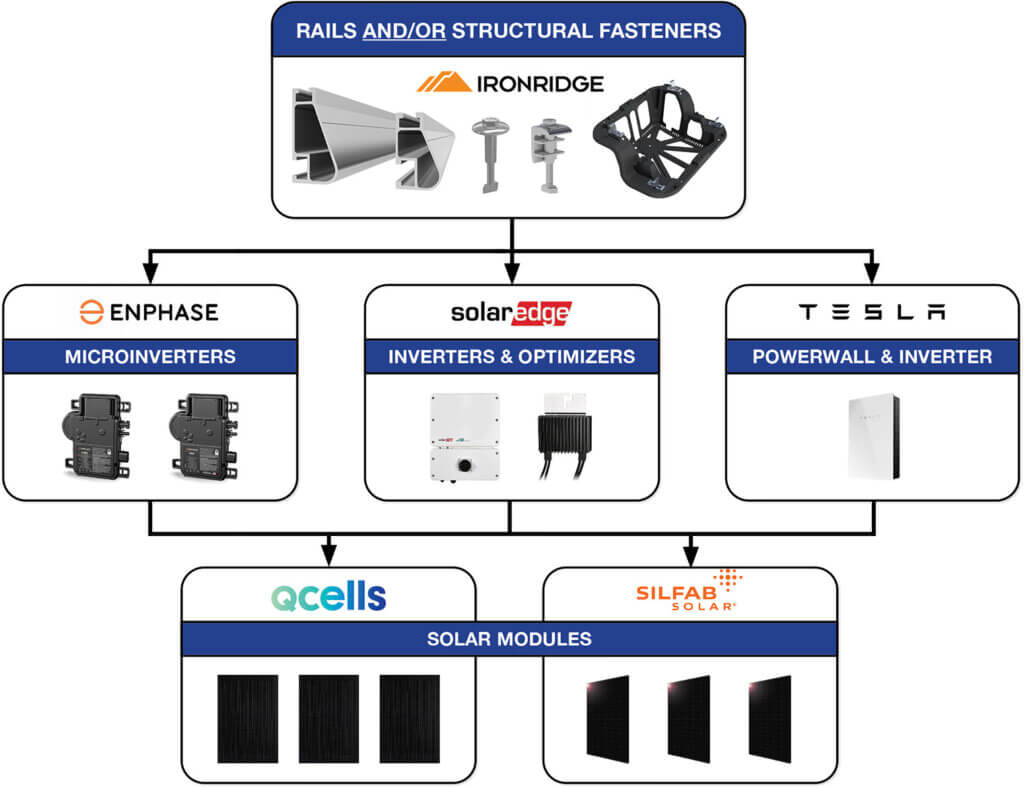

- 40%* can be achieved with considered selection of modules, microinverters and IronRidge racking.

- IronRidge has domestic content capabilities to support commercial asset owners and financiers of third-party-owned residential systems (financed by leases or PPAs).

- Taxpayers must choose under which Treasury guidance they will operate to capture the bonus credit. Consultation with tax and legal counsel is encouraged.

- Homeowners and Contractors are not eligible to capture the 10% domestic content adder.

- Commercial Taxpayers, for example financiers of third-party-owned residential systems (financed through leases or PPAs) can capture the adder and will require domestic content to qualify.

- Under recently release Notice 2025-08, IronRidge rail contributes 15 percentage points toward reaching the 40%* domestic content minimum. Modules and inverters provide a variety of avenues to supplement the rest of the needed percentage. IronRidge is working with both module and inverter manufacturers to offer you the best mix of components.

- The BX system is currently manufactured in the US and can contribute meaningfully to reaching the 40% Domestic Content minimum for C&I projects. Projects using our BX solution can qualify for the ITC Domestic Content bonus credit through the IRS guidance that was issued in May, 2023. Each project must qualify on its own merits; we encourage an informed and counseled taxpayer and advise that they speak to their own tax and legal counsel on this matter. Additionally, IronRidge works with Novogradac, a renewables focused, professional services consulting firm, to provide 3rd party support to those seeking to capture the Domestic Content Bonus Credit. Introductions can be made upon request.